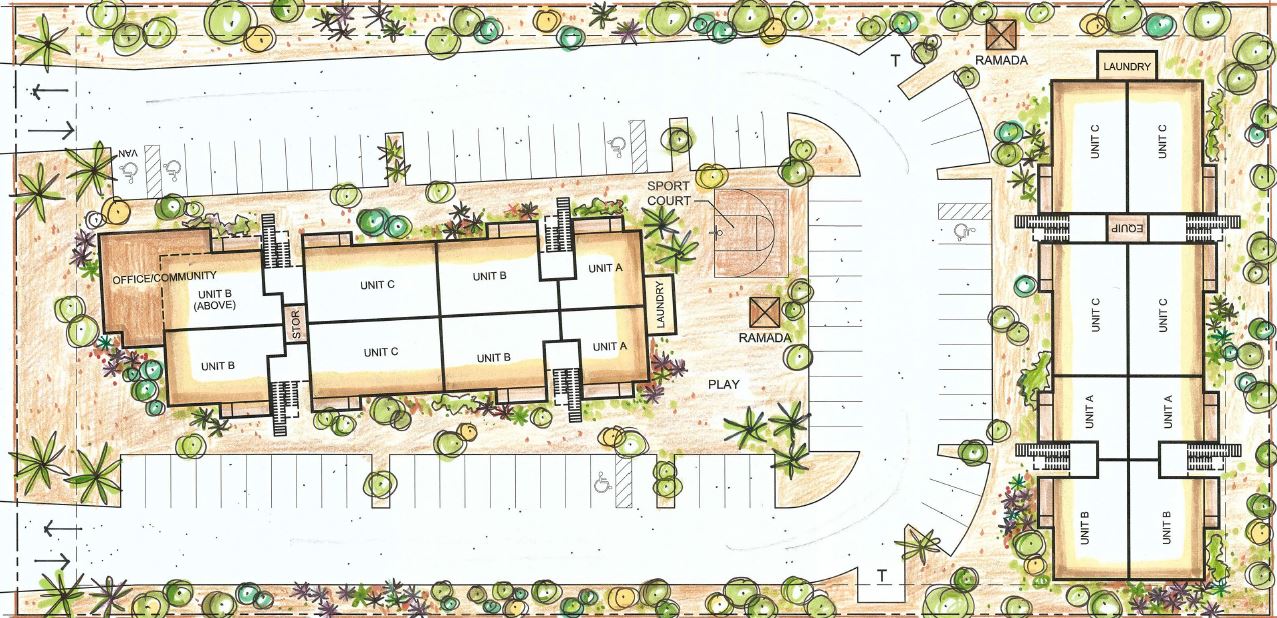

RBR Capital Group is an experienced, hands-on private equity real estate firm in Phoenix, Arizona. Founded in 2007, we specialize in value-add real estate investments up to 20 million with a focus on the retail, industrial, office and residential sectors. We possess a deep skill set that allows us to utilize various strategies to generate superior returns. From the development of land to the repositioning of assets, we possess the capability to realize the maximum potential of each investment.

With expertise in recognizing value-add properties, RBR Capital Group procures and repositions assets to realize superior returns. We do this by implementing unique and creative strategies to generate value — without taking excessive risk. Our deep-market relationships and ability to act quickly provide investors with unparalleled investment opportunities. To show full confidence in each project, we deploy our own funds alongside our partners.

Call us or email us to learn more about how we work. We'd love to hear from you.

23335 N. 18th Dr Suite 134

Phoenix, AZ 85027

"*" indicates required fields